Minds On

Managing a monthly budget

Reflect on the following question:

Is a monthly budget always manageable?

|

Monthly Budget |

|

|---|---|

| Yes, it is always manageable | It is somewhat manageable |

| It is occasionally manageable | It is not at all manageable |

Financial well-being

Why is financial well-being important? Being stable financially means that you don’t have to worry about your expenses overtaking your earnings. Financial decisions involve choices. Sometimes you choose to accumulate debt (e.g. if you are buying a house with a mortgage), and other times something occurs where you don’t have control (e.g. an unexpected vet bill).

It’s important when creating a budget to keep your financial well-being in mind and make choices about what you want versus what you need.

Action

Task 1: Inquiry project

In this learning activity, you will create a monthly budget plan for yourself as you think about your future.

Explore the following questions:

- What career path is interesting to you right now? Choose a career that you would love to have in the future.

- What might you need on a monthly basis in order to achieve financial well-being?

Now, you are going to do some research and use some creativity to create a monthly budget plan for your future self, imagining that you are on the career path that you decided upon.

Below are the success criteria for this inquiry project:

- research the average annual (yearly) income of the career of your choice

- calculate to find the monthly income. Keep in mind that 30% income tax is deducted to get the net income (30% is a fictional flat rate)

- list and describe each type of earning (e.g., monthly income, as calculated after your income tax deduction, plus any other sources of income)

- research the average price of rent in the area in which you might like to live

- research and estimate the average price of bills, such as hydro, transportation, food, etc.

- list and describe each type of expense (fixed expenses, variable expenses and, unplanned expenses)

- find the difference between earnings and expenses. Do you have any savings at the end of the month?

Press the ‘Hint - Monthly Income’ button to learn more about finding your monthly income.

Take your yearly income and divide it by 12 months. Then, you will have your monthly income.

Yearly income ÷ 12 = monthly income

Press the ‘Hint - Income Tax’ button to learn more about calculating income tax.

First, a percentage of a number is always out of 100 so that means that 20% = 20 parts of 100. In decimal form, it looks like this: 0.20 (twenty hundredths).

Now, you need to multiply the number that you are being taxed (let’s pretend it is $200) by 0.20.

200 x 0.20 = 40

This means that you are losing $40 from every $200 you are making to federal income tax.

$200 – $40 = $160

Therefore, if you make $200, and your income tax is 20%, then you will bring home $160 on your paycheck.

Complete the Earning and Expenses Chart in your notebook or by using the following fillable chart.

| Earnings per month | Expenses per month |

|---|---|

|

|

|

Press the ‘Activity’ button to access the Earning and Expenses Chart.

Consolidation

Task 1: Analyze another budget plan

You are going to explore and compare your own budget plan with the plan of another profession.

While you explore this budget plan, find similarities and differences between your budget plan and your classmate's budget plan.

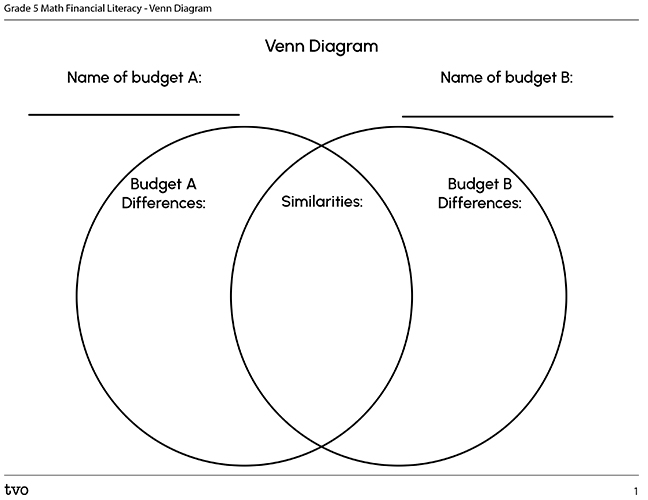

Record these similarities and differences on paper, in chart form, in an audio recording, or by using the following fillable and printable document entitled Venn Diagram.

Reflection

As you read through these descriptions, which sentence best describes how you are feeling about your understanding of this learning activity? Press the button that is beside this sentence.

I feel...

Now, record your ideas using a voice recorder, speech-to-text, or writing tool.

Connect with a TVO Mathify tutor

Think of TVO Mathify as your own personalized math coach, here to support your learning at home. Press ‘TVO Mathify’ to connect with an Ontario Certified Teacher math tutor of your choice. You will need a TVO Mathify login to access this resource.

TVO Mathify (Opens in a new tab)