Minds On

Task 1: Calculating tax for items at a store

The picture below presents different items that you can purchase and their prices. The items and their prices are:

- laptop computer $500

- smartphone $250

- water bottle $20

- book $15

- video game $45

- ice cream $7

- sunglasses $85

- backpack $70

- running shoes $160

What items would you want to buy at this store? Choose the items that you like, and calculate how much money you need to spend!

Document what you are buying and how much you are spending.

If you would like, you can complete the next activity using TVO Mathify. You can also use your notebook or the following fillable and printable document.

Press the ‘TVO Mathify' button to access this resource and the ‘Activity’ button for your note-taking document.

TVO Mathify (Opens in new window) Activity (Open PDF in a new window)What items would you want to buy at this store? Choose the items that you like, and calculate how much money you need to spend!

Make sure you add on the federal tax (5%) and provincial tax (8%) to your spending.

Press ‘How can you calculate tax?’ to review this calculation.

How would you pay for these items at this store? It is a virtual store, so can you think of ways to pay virtually? Does the amount that you’re spending change the type of payment method you will use?

If you would like, you can complete the next activity using TVO Mathify. You can also use your notebook or the following fillable and printable document.

Press the ‘TVO Mathify' button to access this resource and the ‘Activity’ button for your note-taking document.

TVO Mathify (Opens in new window) Activity (Open PDF in a new window)Action

Payment methods

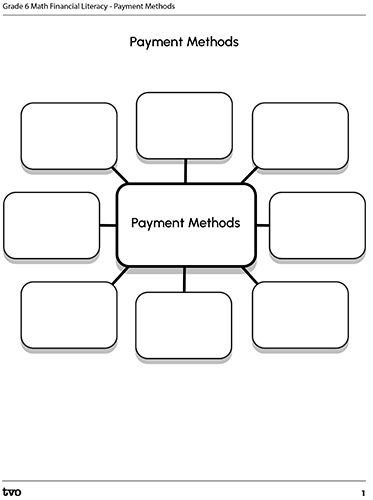

There are many ways that you can spend money. Let’s come up with all of the different ways we can think of to pay for things! We are going to create a mind map, starting with the prompt Payment Methods.

Task 1: Investigating payment methods

Now that we have created a list of many different payment methods, let’s explore them a bit more! We will explain what each method is and how it works using speech-to-text, the table below, or an organizer of your choice.

Complete the Different Payment Methods Chart in your notebook or using the following fillable and printable document.

| Payment method | What is it? | How does it work? |

|---|---|---|

| Debit | ||

| Cheque | ||

| Visa | ||

| E-transfer | ||

| Apple Pay | ||

| Money Order | ||

| Cash |

Press the ‘Activity’ button to access the Different Payment Methods Chart.

Let’s complete the first two rows together! First, use the following video about debit to help you answer the questions. As you are exploring the video, reflect on the following questions: What is debit? How does it work?

Complete the answers in the Different Payment Methods table or an organizer of your choice.

Now, explore the following video about a cheque to answer the following questions: What is a cheque? How does it work? Record your answers.

Task 2: Bank vs. wallet

These payment methods can be grouped into two categories for storing money. You can either keep money somewhere safe physically, like in a wallet, or electronically, like in a bank account. Group each payment method from Task 1 into either category using speech-to-text, the T-chart below, or a chart of your choosing.

Complete the Bank vs. Wallet T-Chart in your notebook or using the following fillable and printable document.

| Bank accounts | In your wallet |

|---|---|

Press the ‘Activity’ button to access the Bank vs. Wallet T-Chart.

Task 3: Delayed payments

If you would like, you can complete the next activity using TVO Mathify. You can also use your notebook or the following fillable and printable document.

Press the ‘TVO Mathify' button to access this resource and the ‘Activity’ button for your note-taking document.

TVO Mathify (Opens in new window) Activity (Open PDF in a new window)What do you do if you don’t have all of the money that you need to purchase something at one time?

One option is to pay in installments. An installment is a sum of money that is less than what the item costs overall. It is offered as multiple equal sums paid over an agreed upon period of time.

For example, the Peloton workout bike costs $2,495. This is a large sum of money to pay at once! A fitness video company that wants many of this type of bike pays for them in installments. Peloton offers the fitness company the opportunity to pay $264/month. They will pay this amount each month for three years and three months until the total amount for the bikes are paid.

Answer the following questions about paying in installments:

- A bank employee needs to buy a car to help them get to work. The car they want costs

$29,500. The employee makes $60,000/year but gets paid $5,000 monthly. They do not have the

money right now to pay for the car all at once. After paying in equal monthly installments,

they will fully pay off their car in four years. How much does each installment cost?

- Can they afford this based on their monthly salary?

- What if they want to finish their car payments in two years? Will they have enough money?

- A bookstore employee just moved to a new apartment and needs to

buy a sofa. They found a nice and comfortable sofa, but it costs a little more than they are

comfortable spending at one time. The sofa cost $7,860. Help the bookstore employee come up

with an installment plan so that they can get the sofa of their dreams. Give them two

options: one where they pay more at a time, but finish the total payment faster, versus one

where they pay less and take longer to complete the payments.

Another option is to pay with a deposit. This means that you pay one sum at the start, as a first installment. The balance, or remaining amount of the money, is paid in full later. This initial payment, or deposit, is considered a commitment to paying the rest later.

For example, when a traveller books a stay in a hotel or an Airbnb, they can pay with a deposit. They might find a weekly stay that costs $1,610. The traveller can pay an initial $230 (the value of one night) when they book their stay, and the remaining $1,380 when they check out.

Answer the following question about paying with deposits:

- A teacher is planning to go on vacation on a cruise ship in the Caribbean with their partner. It costs $8,250 for four nights for both. They paid a deposit of $500. How much will they still need to pay?

Consolidation

Task 1: Purchases and payment methods

Below are pictures of different purchases with their listed prices. For each scenario, calculate the Harmonized Sales Tax (HST). Then, select a payment method and explain why you chose that particular method of payment. You can record your responses using a method of your choice.

Reflection

As you read through these descriptions, which sentence best describes how you are feeling about your understanding of this learning activity? Press the button that is beside this sentence.

I feel...

Now, record your ideas using a voice recorder, speech-to-text, or writing tool.

Press ‘Discover more’ to extend your skills.

Discover more