Minds On

Exploring bank statements

Below is a picture of a bank customer’s statement.

What is a bank statement?

A bank statement is a report of how much money you have in your bank account. It tracks what you have spent money on, what money has been withdrawn (taken out of the bank account), and what money has been deposited (added to the bank account). It also tracks your balance (how much money you have in your bank account).

Over the summer, the customer made $515.00, which they deposited in August. Explore the amount they have in their bank account each month. What do you notice?

From exploring the bank statement, you may notice that the customer has not deposited any more money. They also have not withdrawn any money. However, their balance is increasing each month. Is there a pattern? What is it increasing by?

Student Success

Think-Pair-Share

Come up with a story to explain why this might be happening. Be creative and share your story with a friend!

Note to teachers: See your teacher guide for collaboration tools, ideas and suggestions.

Action

Learning about interest

Here is what is really happening in the customer’s bank account: their balance is increasing because the bank is paying them interest. Interest is paying someone for the use of their money. The bank pays you because you are saving your money with them.

Banks establish their own interest rates, which determine how much they will pay you to use your money. An interest rate is the proportion of an amount that the bank will pay. That means that you are not paid the same amount every month, but the same proportion or percentage.

Description

Description

This is a graph showing interest for 3 months. For September, the interest is at 5 dollars and 15 cents. In October, the interest is 5 dollars and 20 cents. In November, the interest is 5 dollars and 25 cents.

In the example, you will notice that in September, the customer’s money increases by $5.15. In October it increases by $5.20, and in November it increases by $5.25. This is happening because each month the bank calculates a proportion of all the money there. When there is more money in the account, the amount added will be greater!

In this example, the interest rate is 1%. So, every month, 1% of the current balance is added to the account.

Task 1: Calculate a percentage

How do you calculate the percentage of an amount? What is 1% of $515?

Press the ‘TVO Mathify' button to access this interactive whiteboard and the ‘Activity’ button for your note-taking document. You will need a TVO Mathify login to access this resource.

TVO Mathify (Opens in new window) Activity (Open PDF in a new window)Task 2: Paying interest

Who pays interest? A variety of financial institutions pay interest and at different rates. A financial institution is any company that provides and manages monetary (money-based) transactions. Can you think of any financial institutions?

Student Success

Think-Pair-Share

Work with a partner, if possible, to list some examples of financial institutions.

Complete the Financial Institutions list in your notebook, using speech to text, or use the following fillable and printable document.

Note to teachers: See your teacher guide for collaboration tools, ideas and suggestions.

Task 3: Interest rates

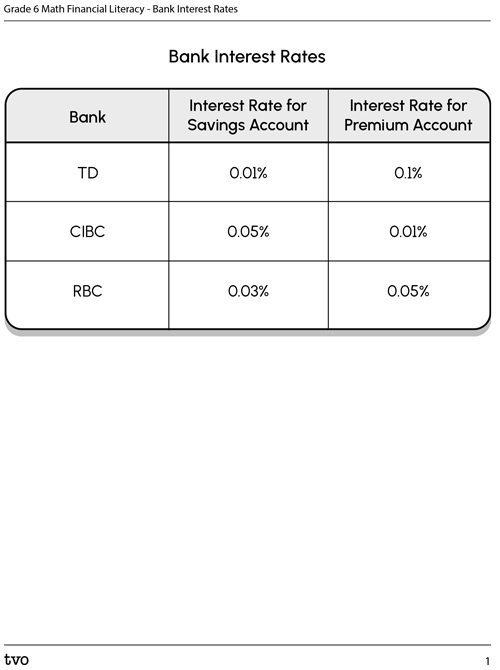

Explore the interest rates below offered by real banks in Canada!

Access Bank Interest Rates using the following printable document.

You will notice that all these percentages are very small numbers. Currently, interest rates on these types of bank accounts will tend to be less than 1%, but once you save a lot of money, that can mean that a lot more is earned! Interest rates change all the time.

Put these interest rates in order from least to greatest. Which account or accounts have the highest interest rate? Which account or accounts have the lowest interest rate? Which account would you want to put your money into? How much money will you make in interest in each account?

Task 4: Making money by saving

Now it’s time to use some interest rates to calculate how much money you can make from saving. You can use a calculator to solve.

If you would like, you can complete the next activity using TVO Mathify. You can also use your notebook or the following fillable and printable document.

Press the ‘TVO Mathify' button to access this interactive whiteboard and the ‘Activity’ button for your note-taking document. You will need a TVO Mathify login to access this resource.

TVO Mathify (Opens in new window) Activity (Open PDF in a new window)Scenario 1:

A hockey player opened a savings account in September with a deposit of $2,500.00. If the bank account has an interest rate of 0.01%/month, how much money will there be in the account in total in October? What about in November? How much money did they make in interest altogether?

Step 1: Convert 0.01% to a decimal.

Step 2: Multiply the decimal by the amount (2,500).

Step 3: Add your answer to the amount (2,500).

Step 4: Repeat steps 1-3 using the new amount in the account for November.

Scenario 2:

A gymnast opened a savings account in January with a deposit of $17,575. If the bank account has an interest rate of 1.2%/month, how much money will there be in the account in February? What about March?

Scenario 3:

An artist is deciding which bank they should use. They want to open a savings account with a deposit of $700. One of the banks has an interest rate of 0.05% and the other bank has an interest rate of 0.1%. Which bank should they use? How do you know?

Consolidation

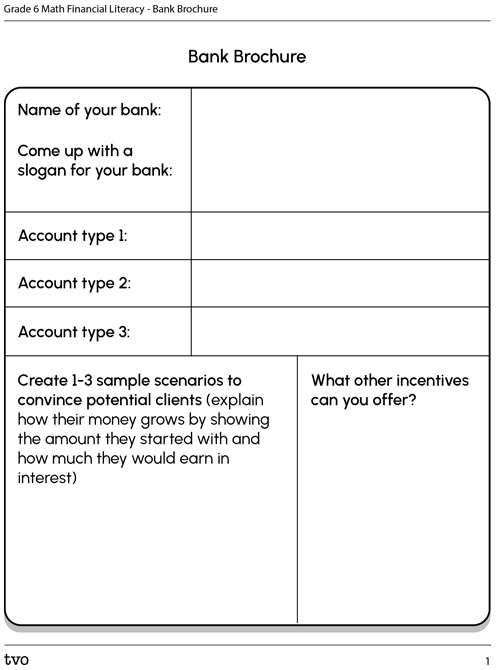

Task 1: Design your own bank

Now you have a chance to design your own bank! Set up a few options for savings accounts, premium savings accounts, or more and develop interest rates for each account. Try to make your bank realistic and appealing to clients. Use a method of your choice to plan out your bank and then make a brochure or commercial that includes all of the information. Be creative and try to convince clients to join your bank!

Be sure that your bank commercial or brochure includes the following information:

- the name of your bank

- a slogan for your bank

- three different account types and the interest rate for each account

- one-to-three sample scenarios showing potential clients how much money they can earn in interest (in their account or accounts)

- other incentives you can offer

Complete the Bank Brochure in your notebook or use the following fillable and printable document.

Reflection

As you read through these descriptions, which sentence best describes how you are feeling about your understanding of this learning activity? Press the button that is beside this sentence.

I feel...

Now, record your ideas using a voice recorder, speech-to-text, or writing tool.

Connect with a TVO Mathify tutor

Think of TVO Mathify as your own personalized math coach, here to support your learning at home. Press ‘TVO Mathify’ to connect with an Ontario Certified Teacher math tutor of your choice. You will need a TVO Mathify login to access this resource.

TVO Mathify (Opens in new window)