Minds On

Financial Situations of Two Families

Explore the following stories of two students’ families and their financial situation:

Student One and their family

Student One and their family live in a small community on the western edge of Manitoulin Island. The nearest grocery store is 40 minutes away from their home. Student One and their family can only afford to buy groceries once every two weeks for two reasons. First, the grocery store is far away from their home and second, their parents earn a limited income.

Student Two and their family

Student Two and their family own a restaurant in downtown Toronto. Recently, construction on a new subway route has begun in front of their family’s restaurant. As a result of this construction, cars are not allowed on the main road. Patrons have stopped visiting the restaurant because of the constant construction activity.

Student Two’s father still has fixed costs to pay. Monthly fixed costs include rent for the restaurant space and mortgage payments for their house. Student Two and their family have had to make significant changes to their lifestyle. These changes include buying fewer clothes and using one vehicle between two parents.

Student Success

Think–Pair–Share

Think:

Explore this TVO article about a community purchasing a shipping container during the pandemic.

Press tvo today to access Why this First Nation bought a shipping container during COVID-19.

TVO dot org (Opens in a new tab)After reading the article and considering the situations of the two students, spend a few minutes considering each of these questions. Record short notes in an audio recording, on paper, or on a computer.

- What factors affect how these students’ families earn and spend their money?

- How were these situations similar? How were they different?

- What are some of the factors a community might consider when deciding to buy a shipping container for local food growth?

Pair:

If possible, exchange your answers to the questions with a partner or with someone at home. What did your answers have in common? What was different?

Note to teachers: See your teacher guide for collaboration tools, ideas and suggestions.

Action

Factors Affecting a Family’s Finances

In the Minds On section, different circumstances affected the finances of Student One and Student Two’s families. As a result, changes in their lifestyle were needed to adjust to these challenges. Some of the factors might be ongoing while others might be temporary. For example, construction happening in the neighbourhood would be temporary.

Examine the factors listed and elaborate on their impact. Reflect on how the factors would affect how families and people earn money and spend money.

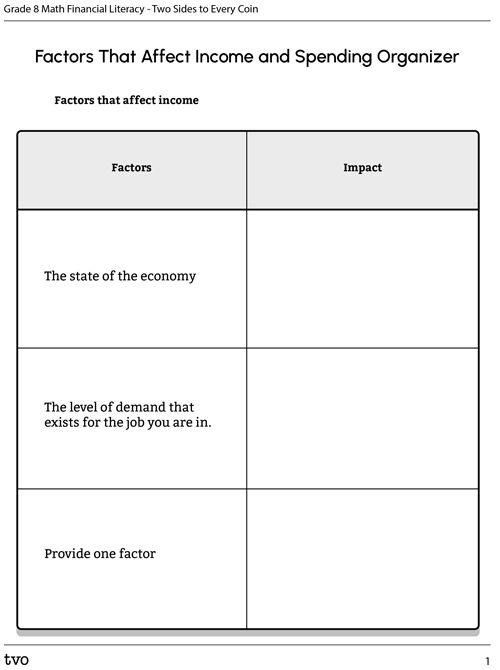

Complete the Factors that Affect Income and Spending Organizer in your notebook or by using the following fillable worksheet to record your thoughts.

Press the Activity button to access the Factors that Affect Income and Spending Organizer.

Activity (Open PDF in a new tab)Factors that Affect Income

| Factors | Impact |

|---|---|

| The state of the economy |

|

| The level of demand that exists for the job you are in. |

|

| Provide one factor |

|

Factors that Affect Spending

| Factors that affect spending | Impact |

|---|---|

| Marketing and media advertisements |

|

| Events, traditions, or holiday celebrations |

|

| Provide one factor |

|

Cost of Accommodation

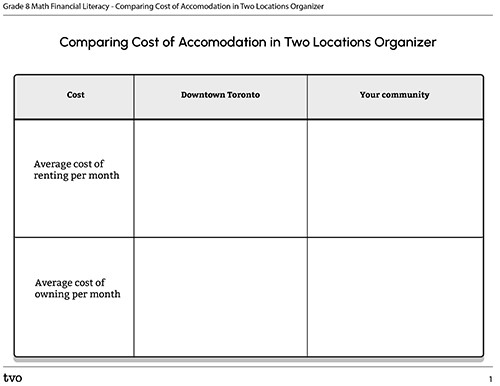

In the previous section, we explored various factors that affect income and spending habits. Now we will apply our knowledge to a scenario comparing renting or owning property. Your task is to research the cost of renting and owning property in two areas in Ontario. The examples you choose should be for similar types of properties (size or number of bedrooms, etc.).

Complete the “Comparing cost of Accommodation in Two Locations Organizer” in your notebook or using the following fillable worksheet for your thoughts.

Press the Activity button to access the Comparing Cost of Accommodation in Two Locations Organizer.

Activity (Open PDF in a new tab)Comparing Cost of Accommodation in Two Locations

| Cost | Downtown Toronto | Your community |

|---|---|---|

| Average cost of renting per month | ||

| Average cost of owning per month |

Student Success

Think–Pair–Share

Think

Spend a few minutes considering each of these questions. Record short notes in an audio recording, on paper, or on a computer.

- What are additional costs to consider when we rent or own property?

- What are the costs involved in renting a property?

- What are the costs involved in buying a property?

- Why might some people prefer to rent property? Why might some people prefer to purchase property?

Pair:

If possible, exchange your answers to the questions with a partner or with someone at home. What did your answers have in common? What was different?

Consolidation

Money as a Metaphor

In this lesson, we explored various factors affecting cost of living. You will now reflect on your learning and design an image or create a metaphor of what money represents to you.

What is a metaphor? A metaphor is a figure of speech that used to make a comparison between two things. The two things are not alike but might have something in common.

“Money is water; it constantly flows” or “Money is a tree; it gradually grows” are examples of metaphors. The interpretation could be argued as invalid depending on several factors discussed above.

Consider the two images below. Are these metaphors effective in depicting the relationship between money and finances?

Create a Money Metaphor

Your task is to reflect on metaphors to describe money based on the factors that we discussed. What metaphors or visuals can you think of to describe money and how it is earned in different contexts?

Complete the activity in your notebook. You can choose to either design an image, create a photo collage, make an audio recording, or write out a metaphor. Be sure to describe your metaphor or images in detail. Connect your idea to the many factors we explored that affect finances.

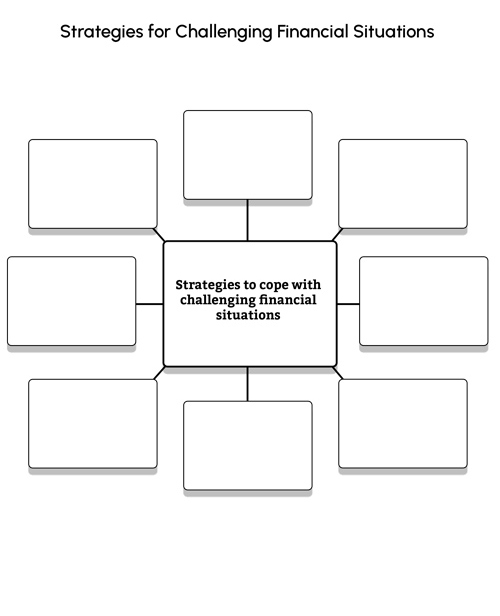

Strategies for Challenging Financial Situations

Sometimes people find themselves in situations that lead to challenging or difficult financial situations.

What are some strategies that people can use in challenging or difficult financial situations?

Include your responses in the concept web or create an audio recording of your reflection.

Press the ‘TVO Mathify' button to access this interactive whiteboard and the 'Strategies for Challenging Financial Situations' button for your note-taking document. You will need a TVO Mathify login to access this resource.

TVO Mathify (Opens in new window) Activity (Open PDF in a new window)Reflection

As you read the following descriptions, select the one that best describes your current understanding of the learning in this activity. Press the corresponding button once you have made your choice.

I feel...

Now, expand on your ideas by recording your thoughts using a voice recorder, speech-to-text, or writing tool.

When you review your notes on this learning activity later, reflect on whether you would select a different description based on your further review of the material in this learning activity.

Join the conversation

Try to think of TVO Mathify as your own personalized math coach, here to support your learning at home. Press ‘TVO Mathify’ to connect with an Ontario Certified Teacher math tutor of your choice. You will need a TVO Mathify login to access this resource.

TVO Mathify (Opens in new window)