Minds On

Doubling power of money

Which would you rather receive? A $100,000 each day for a month or a nickel on the first day, doubling the amount each day for 30 days?

If you would like, you can complete this activity using TVO Mathify. You can also use your notebook or the following fillable worksheet.

Press the ‘TVO Mathify' button to access this resource and the ‘Activity’ button for your note-taking document.

TVO Mathify (Opens in new window) Activity (Open PDF in a new window)Complete the table of values that shows the increase of the nickel over fifteen days and compare this total amount to the $100,000 each day for a month (30 days for this example).

| Term (days) | Term Value |

|---|---|

| 1 | 0.05 |

| 2 | 0.10 |

| 3 | 0.20 |

| 4 | 0.40 |

| 5 | 0.80 |

| 6 | |

| 7 | |

| 8 | |

| 9 | |

| 10 | |

| 11 | |

| 12 | |

| 13 | |

| 14 | |

| 15 |

Continue this calculation by creating a pattern rule or by solving it to determine the greater value - one hundred thousand dollars each day for a month or a nickel doubled each day?

Action

Growth of nickel pattern rule

The pattern rule representing the growth of the nickel over time is:

where:

a = the initial value

b = the multiplier

x = time.

This pattern rule connects to compound interest as the growth of an amount, like the nickel, is compounded over time. Now, let’s explore compound interest as it relates to how we invest our money.

Exploring compound interest over time

An RRSP was opened with an initial investment of $10,000 and maintained a 5% return compounded each year for 10 years. This means compound interest was calculated on the initial principal ($10,000) and on the accumulated interest of each previous period. Think of this interest as “interest on interest,” which will make a loan grow to a higher amount than simple interest. Recall that simple interest is calculated only on the principal amount.

Explore the chart with a partner and discuss the trends apparent over time.

| Year | Annual return | Total return | End of year value |

|---|---|---|---|

| 1 | $500.00 | $500.00 | $10,500.00 |

| 2 | $525.00 | $1,025.00 | $11,025.00 |

| 3 | $551.25 | $1,576.25 | $11,576.25 |

| 4 | $578.81 | $2,155.06 | $12,155.06 |

| 5 | $607.75 | $2,762.82 | $12,762.82 |

| 6 | $638.14 | $3,400.96 | $13,400.96 |

| 7 | $670.05 | $4,071.00 | $14,071.00 |

| 8 | $703.55 | $4,774.55 | $14,774.55 |

| 9 | $738.73 | $5,513.28 | $15,513.28 |

| 10 | $775.66 | $6,288.95 | $16,288.95 |

Compound interest

Compound interest is calculated using a formula that considers the amount borrowed, the rate, the length of time the money is borrowed, and the number of times per year that the interest is compounded.

where:

A = the amount at the end

P = the principal or starting amount

r = the interest rate per year (in decimal form)

t = the time the money is invested or borrowed, in years

n = the number of times per year that interest is compounded

Using the example given in the chart, the end of year value for year ten can be calculated with the compound interest formula.

Therefore, the value of the investment at the end of ten years would be $16,288.95.

Guaranteed Investment Certificates (GIC)

Guaranteed Investment Certificates (GICs) are a form of investment that allows people to make deposits with their bank for a fixed period. GICs are a type of savings account that can’t be touched for a set number of months or years (known as the term). If someone needs to withdraw money before the end of their fixed term, they are either charged a fee or refused entirely. GICs and term deposits usually pay higher interest than savings accounts.

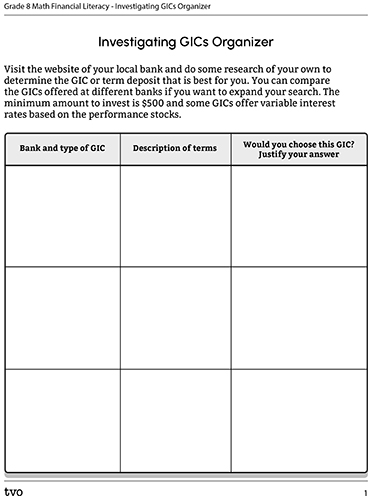

Complete the Investigating GICs Organizer in your notebook or using the following fillable worksheet.

Press the Activity button to access the Investigating GICs Organizer.

Activity (Open PDF in a new tab)Visit the website of your local bank and do some research of your own to determine the GIC or term deposit that is best for you. You can compare the GICs offered at different banks if you want to expand your search. The minimum amount to invest is $500 and some GICs offer variable interest rates based on the performance stocks.

| Bank and type of GIC | Description of terms |

Would you choose this GIC? Justify your answer |

|---|---|---|

If you would like, you can complete this activity using TVO Mathify. You can also use your notebook or the following fillable worksheet.

Press the ‘TVO Mathify' button to access this resource and the ‘Activity’ button for your note-taking document.

TVO Mathify (Opens in new window) Activity (Open PDF in a new window)Let’s explore a GIC being offered by your local bank.

Recall:

where:

t = the time the money is invested or borrowed, in years

n = the number of times per year that interest is compounded

A customer plans to invest $4,000.00 on a GIC that pays 4% interest per year compounded annually (once a year), for 5 years. Determine how much they will earn at the end of their 5-year savings period.

Setting a financial goal

Now, let’s work in reverse! Suppose someone wanted to set a financial goal for themself to save a certain amount of money. We can use the same formula and solve for different variables.

If you would like, you can complete this activity using TVO Mathify. You can also use your notebook or the following fillable and printable worksheet.

Press the ‘TVO Mathify' button to access this resource and the ‘Activity’ button for your note-taking document.

TVO Mathify (Opens in new window) Activity (Open PDF in a new window)Recall:

where:

A = the amount at the end

P = the principal or starting amount

r = the interest rate per year (in decimal form)

t = the time the money is invested or borrowed, in years

n = the number of times per year that interest is compounded

Hint: You will need to use the formula and insert known values to solve for the missing value. This is very much like algebra when you are solving for the unknown variable as you will need to calculate in reverse.

- Suppose they would like to have $6,000.00 in 5 years. They can invest their money at 4% compounded quarterly. How much do they need to invest today (present value) to achieve this savings goal?

- Suppose they would like to have $8,000.00 in 7 years. They can invest their money at 5% compounded semi-annually. How much do they need to invest today (present value) to achieve this savings goal?

- Suppose they would like to have $10,000 in 5 years. They can invest their money at 3% compounded quarterly. How much do they need to invest today (present value) to achieve this savings goal?

Consolidation

Compound interest and compounding periods

In addition, to the compound interest formula, we can also calculate the amount of an investment and the interest earned using an online compound interest calculator. This calculator is also known as a Time Value of Money calculator.

It is also important to note that the compounding period may not always be calculated based on one year. The compounding period can occur more frequently in one year. This means that interest will be paid more frequently on the investment.

The following chart displays common compounding periods:

| Compounding Period | When interest is paid: | Periods per year |

|---|---|---|

| Annually | At the end of the year | 1 |

| Semi-annually | Every six months | 2 |

| Quarterly | Every 3 months | 4 |

| Monthly | Every month | 12 |

| Weekly | Every week | 52 |

| Daily | Every day | 365 |

If you would like, you can complete this activity using TVO Mathify. You can also use your notebook or the following fillable worksheet.

Press the ‘TVO Mathify' button to access this resource and the ‘Activity’ button for your note-taking document.

TVO Mathify (Opens in new window) Activity (Open PDF in a new window)Recall:

where:

t = the time the money is invested or borrowed, in years

n = the number of times per year that interest is compounded

- Calculate the amount of a $1,000.00 investment if the interest rate is 4% and the compounding period is semi-annual and quarterly. What is the future value of the investment and the total interest earned for each scenario?

- Calculate the amount of a $3,527.25 investment if the interest rate is 3% compounded semi-annually for 5 years. What is the future value of the investment and the total interest earned?

- Calculate the amount of a $12,200.57 investment if the interest rate is 3% compounded quarterly for 7 years. What is the future value of the investment and the total interest earned?

Reflection

As you read the following descriptions, select the one that best describes your current understanding of the learning in this activity. Press the corresponding button once you have made your choice.

I feel...

Now, expand on your ideas by recording your thoughts using a voice recorder, text-to-speech, or writing tool.

When you review your notes on this learning activity later, reflect on whether you would select a different description based on your further review of the material in this learning activity.

Join the conversation

Press 'TVO Mathify' to join the conversation and connect with a math tutor.

TVO Mathify (Opens in new window)