Minds On

What are your needs for your money?

Brainstorm

Set some financial goals

It is important to set financial goals for the present and future. With a partner, if possible, reflect on the following:

- What matters to you most when you are looking at trusting your money with a bank?

- Which features or criteria matter most to you, personally, for how you plan to use an account or product?

- Do you care more about avoiding fees/costs, accumulating perks, or convenience?

- Will you access your account/product primarily online or do you need in-person access?

- Do you prefer a large, well-known financial institution or more of a small-business feel?

Action

Comparing banking products

Chequing accounts are a safe, convenient place to keep money where people plan to use for day-to-day spending or to pay bills over the short term. This account is also used to deposit pay cheques or write cheques for people. The interest rates are very low and usually you are allowed a specific number of transactions for a monthly fee. A debit card is also given to access the account.

Consider the three different chequing account options presented in the table below.

|

Options |

A |

B |

C |

|---|---|---|---|

|

Monthly transfer fee |

free |

$5.00 |

$10.00 |

|

ATM use fee |

$1.00 |

free |

free |

|

Fee per cheque |

free |

$1.00 each |

free |

|

Online Banking fees |

free |

free |

free |

|

Debit fee |

$2.00 each |

free |

free |

|

E-transfer fee |

free |

$1.00 |

free |

*Option C will have the $10 monthly fee waived if the account has a $5,000.00 minimum balance.

Brainstorm

Explore the chequing account options

Work with a partner, if possible, and discuss the scenarios in the table. Which one do you feel would be the best option? Explain.

A line of credit is a type of loan that lets people borrow money up to a pre-set limit. They don’t have to use the funds for a specific purpose. They can use as little or as much of the funds as they like, up to a specified maximum. They can pay back the money they owe at any time.

Consider the three different borrowing options presented in the table below.

|

Options |

Features |

|---|---|

|

A |

People can borrow up to $30,000.00. Interest rate is 3% compounded monthly. No minimum payments when paying back the loan. |

|

B |

People can borrow up to $20,000.00. Interest rate is 3% annually. Repayment is minimum $100.00 monthly. Every year, $1,000.00 is added to their borrowing limit if payments are done on time. |

|

C |

People can borrow up to $12,000.00. Interest rate is 5% monthly. No minimum payments when paying back the loan. |

Brainstorm

Explore the line of credit options

Work with a partner, if possible, and discuss the options in the table. Which one do you feel would be the best option? Explain.

Be prepared to share your answers!

Consolidation

Getting a mortgage

Consider the scenarios for three homes listed for sale in Ontario. Home A is closer to the city. Home B is further from the city. Home C is within the city. The costs described in each scenario do not include closing costs and the land transfer tax.

Home A: $950,000

Detached Ranch Style Bungalow with an attached garage, corner lot siding to open space. Very convenient location within steps to public transit and minutes from the highway. Renovated basement with side separate entrance. Appliances included.

Home B: $650,000

Beautiful 3-bedroom free-hold townhome end unit. En suite off master bedroom and large walk-in closet with laundry right there for convenience. Main floor has open concept living room and eat-in kitchen with custom cabinetry and stainless-steel appliances. Large basement is finished with a gas fireplace and it is roughed in for an extra bathroom.

Home C: $485,000

Brand new 600 square foot condominium! This large and bright studio nicely finished, 1 bath and a balcony with great city views. Steps away from the subway station and grocery stores, minutes from the highway. This amazing building includes amenities: gym, party room, visitor parking and 24-hour concierge. The condo has maintenance fees of $720 per month which cover the amenities and utilities.

If you would like, you can complete this activity using TVO Mathify. You can also use your notebook or the following fillable and printable document.

Part 1

Find an online mortgage calculator and input values to help answer the questions. Use Home A and Home B to answer the following questions. You will have to choose an amortization period and the terms of the loan (closed versus open).

Amortization is the amount of time it will take to repay the mortgage in full. A closed mortgage usually has a lower interest rate but less flexibility for paying off the loan early. An open mortgage has a higher rate but can be paid off in full at any time.

1. Calculate how much a potential buyer will need to pay each month if they have an $80,000 down payment.

2. Find the current interest rate on mortgages. What is the best rate? What are the terms of the loan (length of time, closed versus open)? Is it a financial institution with a good reputation? (must be in Ontario).

3. Consider both the length of the term and if it is a closed versus open mortgage, what is the average interest rate at the financial institution you chose?

4. When a buyer pays 2% interest rate per year, how much interest are they paying? How much principal have they paid each year?

Part 2

A potential buyer is considering the condominium (Home C) because it looks a little cheaper. Calculate how much they will pay each month to the bank with the same $80,000 deposit. When they have the monthly payment, consider the maintenance fees.

Press the ‘TVO Mathify' button to access this interactive whiteboard and the ‘Activity’ button for your note-taking document. You will need a TVO Mathify login to access this resource.

TVO Mathify (Opens in new window) Activity (Open PDF in a new window)Comparing average monthly costs

Even though the first two houses don’t have maintenance fees, there are other costs associated with owning a home. To make a realistic comparison of the three scenarios, all the monthly costs need to be compared.

Complete the Comparing Average Monthly Costs Organizer in your notebook or using the following fillable and printable document.

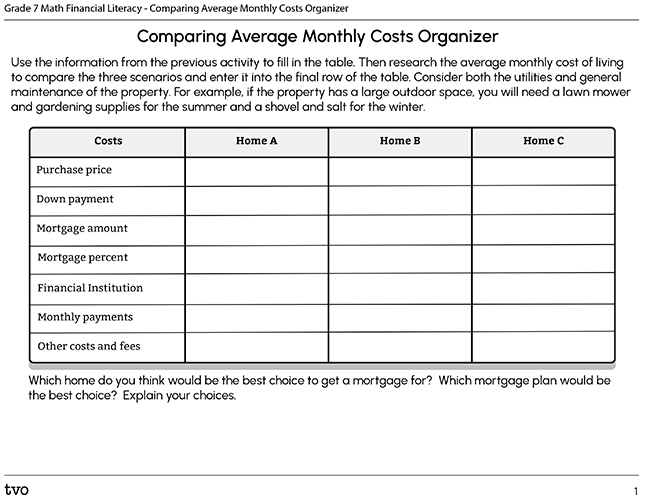

Use the information from the previous activity to fill in the table. Then research the average monthly cost of living to compare the three scenarios and enter it into the final row of the table. Consider both the utilities and general maintenance of the property. For example, if the property has a large outdoor space, you will need a lawn mower and gardening supplies for the summer and a shovel and salt for the winter.

|

Costs |

Home A |

Home B |

Home C |

|---|---|---|---|

|

Purchase price |

|||

|

Down payment |

|||

|

Mortgage amount |

|||

|

Mortgage percent |

|||

|

Financial Institution |

|||

|

Monthly payments |

|||

|

Other costs and fees |

Which home do you think would be the best choice to get a mortgage for? Which mortgage plan would be the best choice? Explain your choices.

Press the Activity button to access Comparing Average Monthly Costs Organizer.

Activity (Open PDF in a new tab)Reflection

As you read the following descriptions, select the one that best describes your current understanding of the learning in this activity. Press the corresponding button once you have made your choice.

I feel...

Now, expand on your ideas by recording your thoughts using a voice recorder, speech-to-text, or writing tool.

When you review your notes on this learning activity later, reflect on whether you would select a different description based on your further review of the material in this learning activity.

Connect with a TVO Mathify tutor

Think of TVO Mathify as your own personalized math coach, here to support your learning at home. Press ‘TVO Mathify’ to connect with an Ontario Certified Teacher math tutor of your choice. You will need a TVO Mathify login to access this resource.

TVO Mathify (Opens in new window)