Minds On

Credit score

A credit score is a number between 300 and 900 that indicates credit history and credit worthiness. Credit scores are calculated using information in credit reports. This information includes the outstanding debt and the length of their credit history.

Brainstorm

Perform a task on your own!

What are some possible factors that may affect a person's credit score? For each factor, determine if it would affect their score a lot or a little, and explain why.

Action

Credit Scores

Credit scores are designed to inform lenders and creditors of a person’s credit history. This helps lenders and creditors make decisions about the ability of a customer to pay a contract. Contracts with lenders and creditors can take the form of a loan, the offer of a credit card, or the approval of a rental application.

According to current trends, young people’s credit scores continue to fall behind their elders. This is usually due to the fact that young people have either misused their credit cards or have not used a credit card at all.

Credit score case studies

Imagine yourself in the role of Financial Advisor for the day. Financial advisors provide clients with sound advice on how to manage their money. They support clients with planning for short-term and long-term financial goals. These goals may include buying a home, investing, minimizing debt, and planning for retirement. Financial advisors research investment opportunities and provide clients with investment strategies to maximize their earnings.

You have two meetings scheduled for today. The first meeting of the day sees you supporting a student in college who would like advice with how to increase their credit score. The second meeting is with a librarian who is trying to pay off debt while increasing their credit score.

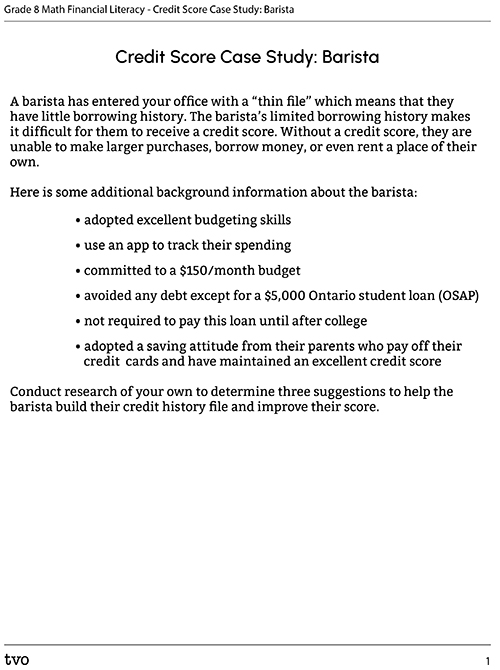

Case 1: Barista

A barista has entered your office with a “thin file” which means that they have little borrowing history. The barista’s limited borrowing history makes it difficult for them to receive a credit score. Without a credit score, they are unable to make larger purchases, borrow money, or even rent a place of their own.

Here is some additional background information about the barista:

- adopted excellent budgeting skills

- use an app to track their spending

- committed to a $150/month budget

- avoided any debt except for a $5,000 Ontario student loan (OSAP)

- not required to pay this loan until after college

- adopted a saving attitude from their parents who pay off their credit cards and have maintained an excellent credit score

Conduct research of your own to determine three suggestions to help the barista build their credit history file and improve their score.

Complete the Credit Score Case Study: Barista in your notebook or using the following fillable and printable document.

| Suggestion | Explanation of suggestion | Source (Where did you find this information?) |

|---|---|---|

Press the Activity button to access the Credit Score Case Study: Barista.

Activity (Open PDF in a new tab)Case 2: Librarian

If you would like, you can complete the next case study using TVO Mathify. You can also use your notebook or the following fillable worksheet.

Your second appointment of the day is with a librarian who has a more complicated financial situation. Their goals are to decrease consumer debt and increase their credit score over a relatively short time frame. Ultimately, they want to leave their part-time library role in two years with an improved credit score and no debt.

Here is some additional background information about the librarian:

- currently working 20 hours a week at the library making $18 per hour

- have not maintained a budget and unsure of where they are spending money

- have three credit cards, co-signed by their parents, and a total of $5,200 in debt

- paying the minimum $34 off the credit card every month with an annual interest rate of 20.4%

- hoping to get a second part-time job at the local grocery store that will pay $14.25 per hour, and willing to work an extra 20 hours a week

- The librarian starts to work 20 hours a week at the grocery store and continues working 20 hours a week at the library. Calculate what the monthly payment on their credit cards would need to be so that they can be debt-free in two years. Remember to consider the interest charged on the outstanding balance every month.

- What percentage of their monthly earnings will be used to pay off their credit card balance?

Press the ‘TVO Mathify' button to access this interactive whiteboard and the ‘Activity’ button for your note-taking document. You will need a TVO Mathify login to access this resource.

TVO Mathify (Opens in new window) Activity(Open PDF in a new window)Investing in the stock market

If a client is exploring new investment strategies to maximize their earnings, a financial advisor may recommend investing in the stock market. This is often a riskier type of investment but can be very profitable for the investor.

- A collection of markets and exchanges where shares of public companies are bought and sold.

- Ownership of a corporation is divided into shares.

- A single share of the stock represents fractional ownership of the corporation in proportion to the total number of shares.

- Corporations issue stock to raise funds to operate their business.

- A person buys a piece of the corporation through stocks.

- The investor has a claim to a part of the company’s assets and earnings.

Investment calculation examples

- Your client would like to invest $5,000, into Amazon and the $5,000 is able to buy your

client 125 shares. What is the price per share?

$5,000 ÷ 125 = 40

Therefore, the price per share would be $40. - Another client has purchased 2400 shares of Apple with a per share purchase price of

$175. What is the total cost of the investment?

2400 × $175 = $420,000

Therefore, the total cost of the investment would be $420,000.

If you would like, you can complete the next word problems using TVO Mathify. You can also use your notebook or the following fillable worksheet.

Task #1

On October 1, you invest $7,500 into Tesla, which allows you to buy 100 shares. On October 30, Tesla announces that a new model of its car will be released. The price of the stock has now gone up 15%. You decide to sell your shares to take your profit.

- What was the price per share when you made your investment?

- What was the price per share when you sold your shares?

- What is your overall profit?

- What is your profit per share?

Task #2

You own 250 shares of Apple that cost you $10,000. Apple had a recall on their latest iPhone, and investors began to sell their stock. The price of the stock went down 25%.

- What is your overall loss?

- How much did you lose per share?

Press the ‘TVO Mathify' button to access this interactive whiteboard and the ‘Activity’ button for your note-taking document. You will need a TVO Mathify login to access this resource.

TVO Mathify (Opens in new window) Activity(Open PDF in a new window)Consolidation

Playing the Stock Market

Task

Create your own imaginary investment in a real or imaginary company. Be sure to include the following in your investment scenario:

Stock market simulation reflection

In a Math communication journal of your choosing, reflect on the following questions related to the simulation activity. Be sure to use the sentence starter provided to assist you with generating ideas.

- What did you learn in the simulation activity?

- How did investing in stocks make you feel?

- Reflect on what you have learned about stocks by using the following sentence starter, “I used to think…. Now, I know…”

Reflection

As you read the following descriptions, select the one that best describes your current understanding of the learning in this activity. Press the corresponding button once you have made your choice.

I feel...

Now, expand on your ideas by recording your thoughts using a voice recorder, speech-to-text, or writing tool.

When you review your notes on this learning activity later, reflect on whether you would select a different description based on your further review of the material in this learning activity.

Press ‘Discover More’ to extend your skills.

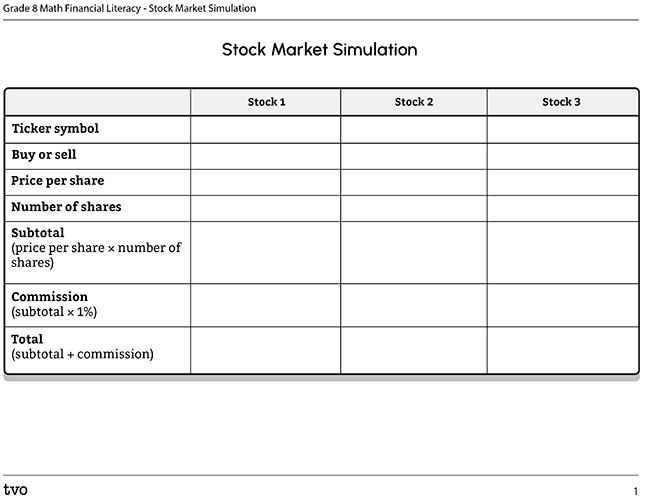

Discover MoreStock market simulation

One of your clients is interested in learning more about the stock market, but they don’t want to take a risk and invest their money just yet. As such, you decide that it’s best that they explore the stock market first by doing their research and engaging in a simulation activity. This simulation may either be done in groups or individually.

This activity should be done over several months to emphasize long-term investments. It can be done over one to two weeks as well. Establish the timeline before beginning the activity.

As a group, first establish a timeline for the activity. Ideally, the activity would be completed over a period of months so stocks have the chance to naturally fluctuate with given market conditions.

Each group (or individual) begins with $1,000. With this money, the group (or individual) must spend at least $900 on stocks through the Toronto Stock Exchange. The remainder may be kept in a chequing account.

Each group must invest in a minimum of 3 stocks and a maximum of 5 stocks.

A 1% commission is to be paid for every stock transaction (buying or selling a stock).

Each group must keep track of the following:

- activities

- stock transactions

- current portfolio value

- chequing account balance

Students will sell their stocks on the last day of the activity (closing day). On closing day, students will report on their portfolio’s value and what they learned during the activity.

The group or individual with the largest portfolio will ring the closing bell in a market closing ceremony.

Investment tracker

Complete the Stock Market Simulation in your notebook or using the following fillable and printable document.

| Stock 1 | Stock 2 | Stock 3 | |

|---|---|---|---|

| Ticker symbol | |||

| Buy or sell | |||

| Price per share | |||

| Number of shares | |||

|

Subtotal |

|||

|

Commission |

|||

|

Total |

Connect with a TVO Mathify tutor

Think of TVO Mathify as your own personalized math coach, here to support your learning at home. Press ‘TVO Mathify’ to connect with an Ontario Certified Teacher math tutor of your choice. You will need a TVO Mathify login to access this resource.

TVO Mathify (Opens in new window)